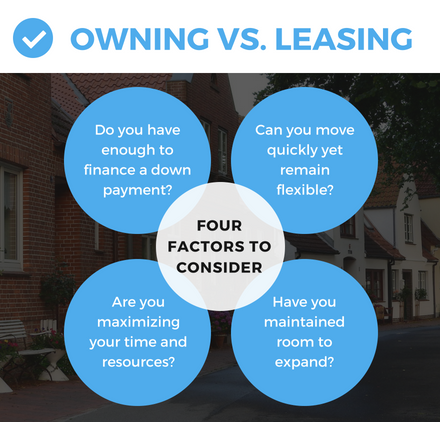

With the Federal Reserve announcing their plans to raise interest rates at least two more times this year, determining whether to buy or lease property has likely become a more important decision for service providers. At CapGrow Partners, we understand the real estate market, as well as the impact interest rates can have on owning vs. leasing a community-based home. Here are four important factors to consider—and how we can support your decision.

Factor 1: Do you have enough to finance a down payment or deposit?

Factor 1: Do you have enough to finance a down payment or deposit?

Key considerations:

- Purchasing property with a traditional loan requires a down payment that is typically 10-40% of the total value of the property.

- Purchase requires capital immediately on hand and often means providers must put their finances toward real estate, rather than the day-to-day needs of the organization.

- When added to the interest rate required in the terms of the loan, the cash outlay for purchasing a home can be extremely high.

CapGrow’s solution: We have the appropriate financial resources immediately available to secure the home you need. As a result, your days of deal with real estate loans and applications is over! Our Partners find that leasing from us provides less financial strain, and increases their operational flexibility. We offer multiple leasing solutions and are able to customize plans to fit each organization’s unique needs.

Factor 2: Can you move quickly yet remain flexible?

Key considerations:

- Desirable real estate is typically sold quickly, which can make finding and purchasing a new home very difficult.

- The home(s) needed are often in large cities and in rural areas—sometimes in several different counties or even states—which requires team members to work with multiple realtors and navigate the nuances in a variety markets.

- Funding from a bank or an external source takes time and resources.

CapGrow’s solution: We are cash buyers; this means we are usually able to put offers in on homes in less than 24 hours. Because we offer services nationwide and work with local experts, we can assist in navigating markets and identifying appropriate options. We move quickly to secure the home(s) deemed most appropriate. Typically, we ensure our partners are able to move into an existing home in 30-45 days; for custom-built homes, the typical time frame is between 5 and 12 months.

Factor 3: Are you maximizing your time and resources?

Key considerations:

- Searching through available real estate takes a lot of time.

- Valuable staff energy and resources can often be drained significantly when organizations have to send their employees out to look for property.

- Navigating a shifting real estate landscape (and shifting interest rates) places greater importance on negotiating terms, conditions and time frames—a task which can feel daunting to employees.

CapGrow’s solution: We handle all of the real estate responsibilities, which saves time and resources. This means we take on the heavy lifting of finding the best real estate agents, finding the right property and handling all the necessary negotiations, inspections and appraisals. This frees up valuable staff time and financial resources to be directed toward client services, training and other operational concerns essential to keeping things running smoothly.

Factor 4: Have you maintained room to expand?

Key considerations:

- Service providers who wish to expand their business often find their growth inhibited when limited to purchasing property.

- Cash flow isn’t available to support growth—whether it’s hiring new employees, adding additional services or implementing new technology, etc.

- Expansion into new states means new markets, rules and regulations.

- Purchasing multiple homes quickly can tie up valuable resources.

CapGrow’s solution: By partnering with us and choosing to lease rather than own, organizations can stretch their money out over time and more easily accommodate plans for development and growth, while at the same time feeling secure in knowing that home is theirs—and more importantly the individual’s—for as long as they want it.

To discuss owning vs. leasing a group home further or to find out more about our customizable lease solutions, contact Alexis Budge or visit our website.